No Cap Fund is a single-issue, bipartisan organization dedicated to uncapping the House of Representatives before the 2030 census.

When in the course of human events, power centralizes, and the people struggle to hold their government accountable, we are compelled to reflect. We must ask: what kind of nation do we wish to be? Do we want to be a free and independent people, where out of many, we become one? Do we want to be united in purpose to govern ourselves, sharing authority and responsibility? Or do we want to become another drifting republic, where power escapes the reach of the people and slides toward tyranny or anarchy?We hold these truths to be self-evident: that people were created free, that a Republican form of government derives its powers from the consent of the governed, and that consent is given through representation accountable to the people.Since 1929, the people’s power in the House of Representatives has remained capped at 435 seats, despite the American population having tripled. This artificial and arbitrary limitation concentrates power, distorts Democracy, and undermines the relationship between citizen and representative. The 435 member cap violates the very purpose for which representative government was established —to be accountable to The People.Therefore, we unite to:First, Support Reform:

We must increase the size of the House of Representatives to remain a free people. Second, Champion Honest Debate:

We welcome rigorous discussion on the methods of expansion.Third, Push for a Vote:

We demand that Congress hold hearings and openly debate legislation to uncap and modernize the House. Fourth, Expand the Tent:

We must engage Americans of all political stripes in this cause. In support of these commitments, we promise one another our good faith effort, honest voice, and steadfast commitment to peaceably repair representation to The People and balance under our great Constitution.

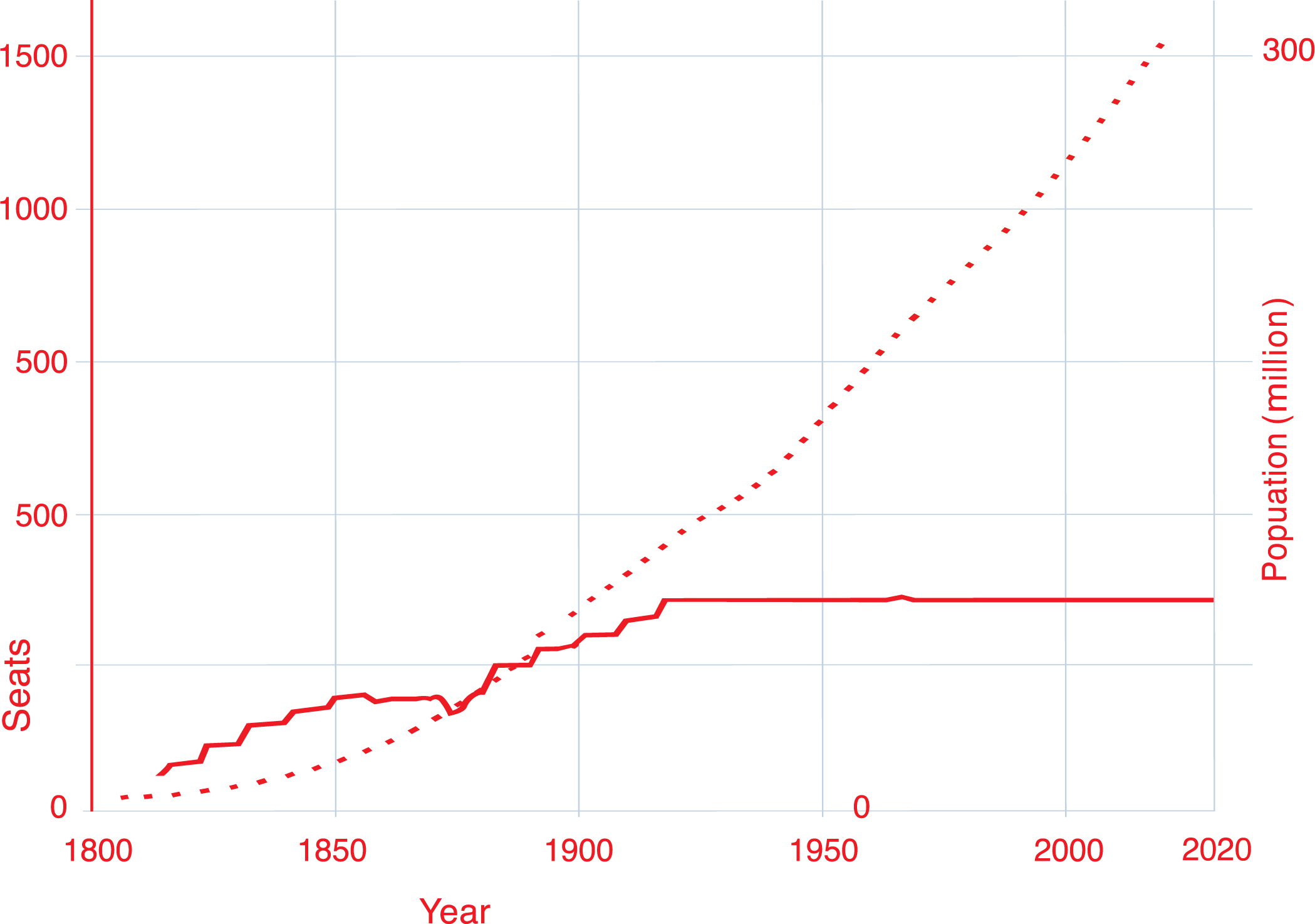

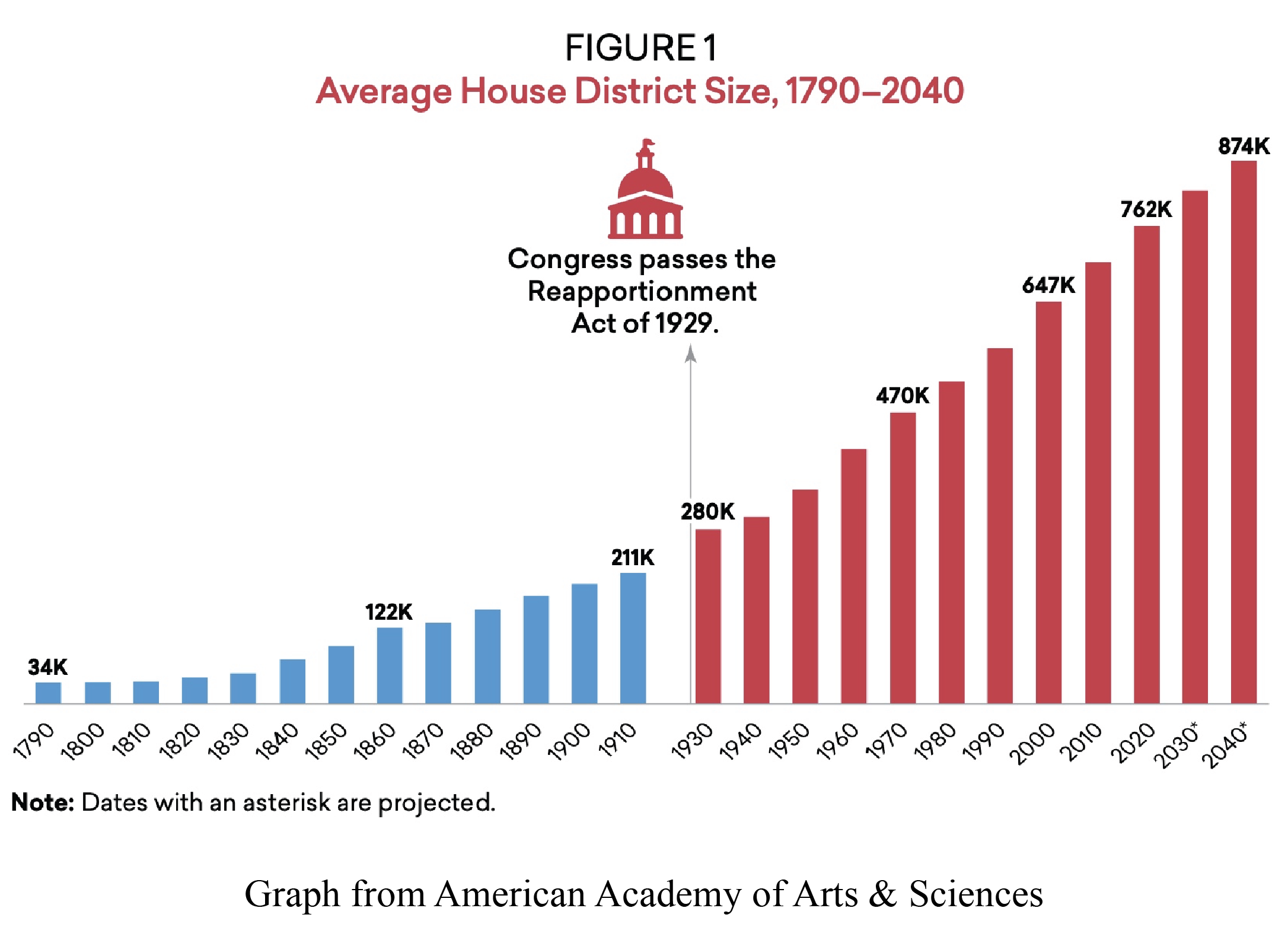

Have you ever considered your representation? There are fifty senators in the Senate, two representatives per state. Have you ever wondered why we have 435 representatives in the House? The Constitution instructs Congress to reapportion the members of the House every ten years after the census. So, why has it been 435 for so long?The history goes like this…Between 1920 and 1929, while Americans adjusted to a rapidly expanding economy and population, returning from war, and were taxed to pay for the debt, Congress failed to apportion the House due to political disputes over urban vs. rural representation. And then quietly capped the people’s power, passing the Permanent Apportionment Act of 1929 and limiting representation in the House to 435 seats. While the number may have been adequate for 1929, the population has tripled to nearly 330 million. In 1929, each House member represented 220,000 people; today, that number is about 750,000. As the population grew while representation remained capped, the people's power was diluted.The House's capping and the increase in population have shrunk our republic, making it ripe for corruption and control. With fewer representatives, elections become more expensive, lobbyists gain more influence, and the average citizen's voice gets drowned out. Thus, the House becomes a place for a wealthy and exclusive political class instead of a place for the people.Click Uncap the House below to learn more about Representation and why we must Uncap The House of Representatives to restore self-government.Your voice matters

It’s your government, take the reins.

help empower American Self-Government?

Email your Representative. Click below for an email template.Sign up to volunteer by clicking below.No Cap Swag

The No Cap Team

The Representation Station is our flagship show dedicated to exploring representation and political reform.Articles On expanding the House

FAQ

-

Our mission is to expand the size of the House of Representatives by removing the existing 435-member “cap.”

Historical Context:

Following the Constitutional Conventions to amend the US Constitution, the 1st Congress proposed an amendment to provide a specific ratio of persons to House Representatives. This amendment, dubbed “Article the First,” preceded 11 other proposed amendments. Ten of these proposed amendments were ratified as the Bill of Rights. The other amendment not part of the Bill of Rights was eventually ratified in 1992. The only amendment not officially ratified was Article the First.Turning Away from the Constitution:

After failing to ratify Article the First, Congress expanded the size of the House every decade after the taking of the US Census as the size of the overall population expanded. Then, after the 1920 Census, Congress failed to pass an apportionment act to expand the size of the House in accordance with this constitutional precedent. To maintain some semblance of order, Congress passed the Permanent Reapportionment Act of 1929, which “capped” the number of Representatives at 435 (a number arrived at in 1911) by automatically reverting back to 435 if Congress failed to pass an apportionment act. Over time, Congress never returned to fulfill its constitutional duty to expand its membership size, and by extension expand representation to the People.The Consequences:

Despite subsequent societal shifts, including the enfranchisement of women, Native Americans, and Black Southerners, and a tripling of the population, Congress has neglected its duty to adjust representation. Furthermore, the Executive branch grew rapidly as the small size of the House exacerbated the need to delegate Congressional powers. This has led to a bureaucratic nightmare and eroded the trust in our political institutions.Our Mission:

The No Cap Fund aims to repair the damage done by failing to expand the House in a nonpartisan manner for the social welfare of America in accordance with our founding principles. -

More than 435. We believe in removing the cap created by the Permanent Apportionment Act of 1929, and replacing it with a dynamic algorithm.

There are many proposals to expand the size of the House including the Wyoming/Smallest State Rule, the Cube Root Rule, the Least Variation Rule, and so many others. We support any method to expand the size of the House beyond the current 435-member cap. -

It depends. Because we are a 501(c)(4) and not a 501(c)(3), contributions or gifts to the No Cap Fund are not deductible as charitable contributions for individual federal income tax purposes.

But, your contributions may be deductible as a business expense under section IRC 162. Please talk to your CPA to learn more about your options. No Cap Fund does engage in limited lobbying. For FY 2025, 10% of any contribution is nondeductible, and 90% is deductible.

-

No Cap Fund does engage in limited lobbying (see the above FAQ!). Most of our lobbying, and all of our political expenditures, however, occur through the “separate segregated fund” we maintain for “exempt functions” as defined by IRC 527(e)(2). That fund is referred to as that No Cap PAC and is in its infancy. If you want your funds to go strictly to lobbying and political expenditures, please visit and donate at the No Cap PAC!

-

Our initial funds are educating and engaging with more Americans., including our grassroots action network.

We are

A 501(c)(4) incorporated in Wyoming.